AI in Finance: Redefining Risk Management and Predictive Analytics

Artificial Intelligence (AI) is transforming the financial industry, enabling organizations to make smarter decisions, optimize processes, and foresee potential risks. Two key areas where AI’s impact is most profound are risk management and predictive analytics. This article explores the diverse applications of AI in these sectors, its advantages, real-world use cases, and the future implicaitons.

Understanding the Role of AI in Finance

Finance is data-driven industry, where success often hinges on accurate analysis, risk assessment, and foresight. Traditional methods of managing financial risks relied heavily on historical data, manual analysis, and human intuition. However, these methods have limitations, especially in rapidly changing markets. AI fills this gap by leveraging machine learning (ML), deep learning, and natural language processing (NLP) to process vast amounts of data and uncover patterns that human might miss.

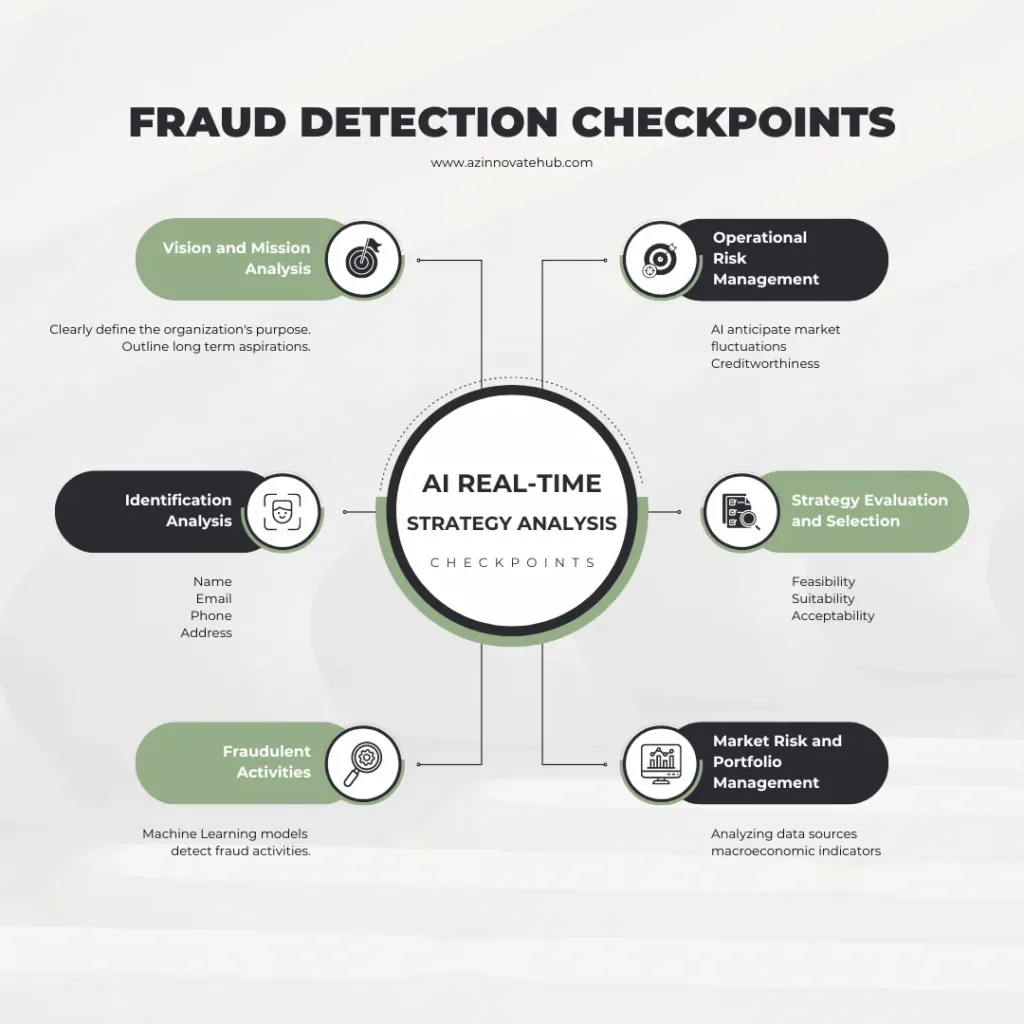

How AI is Transforming Risk Management

- Credit Risk Assessment: Ai-powered credit scoring systems provide more precise and real-time credit risk analysis. Algorithms assess a borrower’s creditworthiness by analyzing a broad range of factors, such as transaction history, social media behavior, and employment records. This results in quicker, more accurate lending decisions and reduces the risk of defaults.

- Real-World Example: ZestFinance, a US-based fintech firm, uses AI algorithms to analyze up to 70,000 different variables in credit applications, enabling lenders to reduce risk while offering loans to previously underserved groups.

- Fraud Detection and Prevention: AI helps identify suspicious activities in real time by detecting anomalies in transaction patterns. Machine learning models can differentiate between legitimate and fraudulent activities, minimizing false positives and ensuring efficient detection.

- Market Risk and Portfolio Management: AI predicts market trends by analyzing a variety of data sources, including market sentiment, news articles, and macroeconomic indicators. This allows firms to optimize their portfolios by proactively adjusting asset allocations based on risk tolerance and market conditions.

- Operational Risk Management: AI tools streamline compliance processes by automating document reviews, transaction monitoring, and adherence to regulatory frameworks such as GDPR and CCPA. Natural language processing (NLP) algorithms can sift through legal documents and identify compliance risks, enhancing accuracy and efficiency.

Predictive Analytics: Forecasting the Financial Future

Predictive analytics uses AI to project future outcomes based on historical data and trends. In finance, this enables proactive decision-making, enhances strategic planning, and provides insights that drive business growth.

- Investment Decision-Making: AI-driven predictive models analyze market data, social media trends, and even political developments to forecast stock prices and investment opportunities. This reduces the reliance on human guesswork and increases the accuracy of investment strategies.

- Customer Behavior Analysis: Financial institutions use AI to analyze customer behavior, helping them understand spending habits, financial health, and future needs. This analysis allows for personalized service offering and product recommendations, ultimately boosting customer satisfaction and retention.

- Predicting Economic Conditions: By analyzing economic indicators and global events, AI can forecast potential economic scenarios, helping financial institutions prepare for downturns, recessions, or booms. This predictive capability allows for more informed strategic planning and risk mitigation.

Benefits of AI in Finance

Implementing AI in financial risk management and predictive analytics offers several benefits:

- Enhanced Accuracy: AI models use real-time data and sophisticated algorithms, resulting in more accurate predictions and risk assessments.

- Efficiency Gains: Automating complex tasks such as fraud detection, compliance monitoring, and credit scoring reduces manual effort and processing times.

- Cost Savings: Reducing human error and optimizing resources lead to substantial cost reductions.

- Proactive Decision-Making: Predictive analytics empowers organizations to anticipate changes and adapt strategies proactively, minimizing the impact of unforeseen events.

Real-World Success Stories

Several leading financial institutions have integrated AI into their core processes:

- JPMorgan Chase uses AI for document review, drastically reducing the time required to analyze legal contracts.

- Wells Fargo utilized AI for fraud detection, detecting suspicious activity faster and with greater precision.

- Goldman Sachs relies on AI for risk management, using predictive analytics to manage their vast investment portfolios.

Challenges and Considerations

Despite its benefits, AI in finance adoption is not without challenges:

- Data Privacy and Security: Compliance with GDPR, CCPA, and other data protection regulations is critical to avoid legal pitfalls and maintain customer trust.

- Algorithm Bias: Ensuring that AI in finance models do not inherit biases from historical data which is crucial for maintaining fairness in decision-making.

- Integration Costs: Implementing AI in finance systems requires significant investment in infrastructure, talent, and ongoing maintenance.

The Future of AI in Finance

As AI continues to evolve, role of AI in finance will only expand. Innovations like Explainable AI (XAI) will make it easier for organizations to understand how decisions are made, increasing transparency and trust. Additionally, advancements in quantum computing and AI could unlock new levels of risk management and predictive capabilities.

Conclusion

AI has already made significant strides in transforming risk management and predictive analytics in finance. From credit scoring and fraud detection to market forecasting and customer behavior analysis, AI’s impact is undeniable. By leveraging AI, financial institutions can stay ahead of the curve, make more informed decisions, and manage risks more effectively, setting the stage for a more secure and prosperous financial future.

Hello, friend!

azinnovatehub.com, It’s clear you put real effort into your site—thank you.

I recently published my ebooks and training videos on

https://www.hotelreceptionisttraining.com/

They feel like a standout resource for anyone interested in hospitality management studies. These ebooks and videos have already been welcomed and found very useful by students in Russia, the USA, France, the UK, Australia, Spain, and Vietnam—helping learners and professionals strengthen their real hotel reception skills. I believe visitors and readers here might also find them practical and inspiring.

Unlike many resources that stay only on theory, this ebook and training video set is closely connected to today’s hotel business. It comes with full step-by-step training videos that guide learners through real front desk guest service situations—showing exactly how to welcome, assist, and serve hotel guests in a professional way. That’s what makes these materials special: they combine academic knowledge with real practice.

With respect to the owners of azinnovatehub.com who keep this platform alive, I kindly ask to share this small contribution. For readers and visitors, these skills and interview tips can truly help anyone interested in becoming a hotel receptionist prepare with confidence and secure a good job at hotels and resorts worldwide. If found suitable, I’d be grateful for it to remain here so it can reach those who need it.

Why These Ebooks and Training Videos Are Special

They uniquely combine academic pathways such as a bachelor of hospitality management or a master’s degree in hospitality management with very practical guidance on the duties of a front desk agent. They also cover the hotel front desk receptionist job description, and detailed hotel front desk duties and responsibilities.

The materials go further by explaining the hotel reservation process, check-in and check-out procedures, guest relations, and practical guest service recovery—covering nearly every situation that arises in the daily business of hotel reception.

Beyond theory, my ebooks and training videos connect the academic side of hospitality management studies with the real-life practice of hotel front desk duties and responsibilities.

– For students and readers: they bridge classroom study with career preparation, showing how hotel management certificate programs link directly to front desk skills.

– For professionals and community visitors: they support career growth through questions for reception interview, with step-by-step interview questions for receptionist with answers. There’s also guidance on writing a strong receptionist description for resume.

As someone who has taught resort management for nearly 30 years, I rarely see materials that balance the academic foundation with the day-to-day hotel front desk job requirements so effectively. This training not only teaches but also simulates real hotel reception challenges—making it as close to on-the-job learning as possible, while still providing structured guidance.

I hope the owners of azinnovatehub.com, and the readers/visitors of azinnovatehub.com, will support my ebooks and training videos so more people can access the information and gain the essential skills needed to become a professional hotel receptionist in any hotel or resort worldwide.

Appreciate you and your community.

Hi there,

Thank you for your kind words about our site, azinnotaehub.com, we really appreciate you taking the time to share your feedback. And thank you for reaching out about the training videos and ebooks you’ve created. It sounds like a fantastic resource for anyone wanting to get into hospitality. The fact that it’s grounded in real-world experience, especially from your nearly 30 years in resort management is what makes it so valuable.

The goal of AZ Innovate Hub is to help our visitors find practical and inspiring content and your material seems to fit perfectly with that mission. Thanks again.